Petrol station automation in the KSA: key benefits and compliance with the state regulations

Key benefits #

Automation of petrol stations is spreading rapidly providing following advantages and benefits for all participators:

- OMCs and independent owners are taking precise control over their stations and major operations (fuel sales, inventory, shifts, etc.). Additional application generates real-time database for decision making process, simple manual interactions between sites and Head-Office can be eliminated and provided by an automation system

- Drivers are getting full freedom in their service: they can use different payment methods, advances self-service technology, book fuel before visiting a petrol station, participate in difference loyalty programs, and get a fuel whenever they need

- Local governments are getting possibility to implement their fiscal and tax policies, avoid “grey” fuel market as information on each dispensed or stored liter will be delivered to their centralized servers for real-time reporting and evaluation

Government regulation in the Kingdom of Saudi Arabia #

Over the past few years new regulation policies have been implemented by different authorities in the KSA. Current regulations which are under implementation:

- Qualification of petrol stations based on some strict standards set up by the Ministry of Energy. This regulation includes a list of standards which petrol stations have to correspond. It is mostly about legal activity according to government rules and as the outcome – getting an additional discount for fuel purchased from the state. Petrol station owners are under enforcement and are looking for solutions to be qualified. In terms of automation such requirements must be provided: remote price update at petrol pumps and price signs, centralized management under fuel remains and sales at the head-office, reporting on issues/technical support and fuel transportation management.

- E-invoicing regulation with the VAT Legislations operated by the Zakat, Tax and Customs Authority (ZATCA). Nowadays even basic requirements to print receipts and saving transactions among petrol stations are extremely rare. And even if petrol station has E-Invoicing solution, it creates complexity during driver service.

The Ministry of Energy’s regulation covers only the operation of petrol stations, meanwhile, ZATCA has been appointed to provide tax regulation among all taxpayers, including drivers on petrol stations. The owners of petrol stations/fuel retailers have to fit both regulations at the same time.

ZATCA and E-invoicing regulation #

Electronic invoicing was rolled-out in two phases in the KSA:

- For the Phase 1, enforceable as of December 4th, 2021, for all taxpayers (excluding non-resident taxpayers), and any other parties issuing tax invoices on behalf of suppliers subject to VAT, electronic invoice issuance will be very similar to today, with invoices issued through a compliant electronic solution and including additional fields depending on the type of the transaction

- Phase 2, known as the Integration phase and rolled-out in waves by targeted taxpayer group, will involve the introduction of Phase 2 technical and business requirements for electronic invoices and electronic solutions, and the integration of these electronic solutions with ZATCA’s systems

Automation solution for petrol station owners and retails #

In our product portfolio Technotrade has hardware and software solutions to comply with state regulations plus get petrol stations qualified. Below you may find very simple and cost-effective solution in this regard. It can be easy duplicated among all petrol stations in the Kingdom of Saudi Arabia.

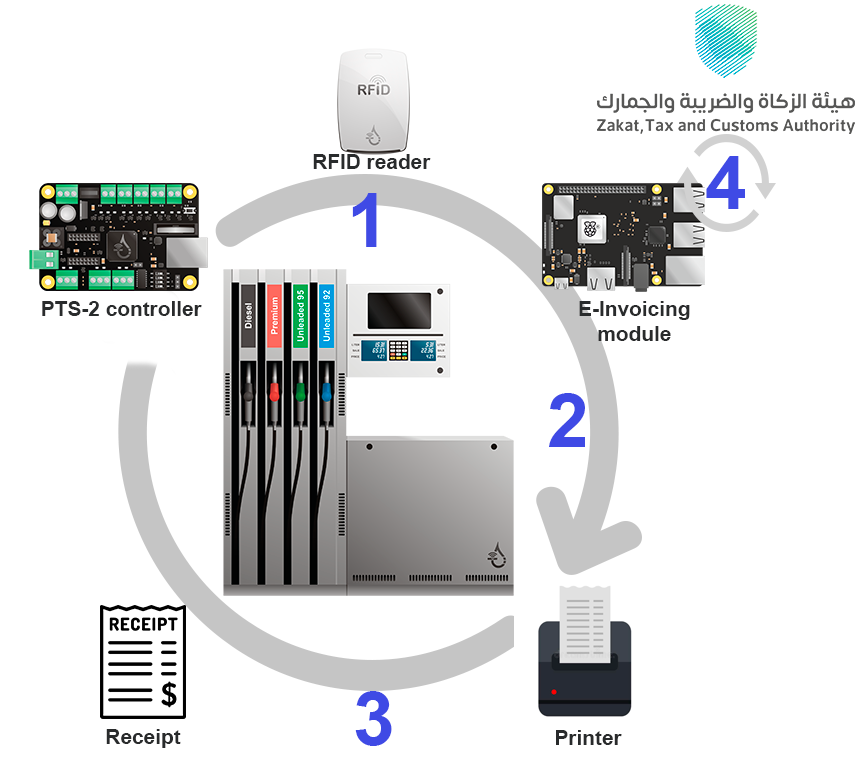

The sequence of operations #

- PTS-2 forecourt controller is keeping constant connection with petrol pumps for getting information on fuel preset. E-invoicing module is getting transactions and all related information from controller.

- By the driver’s request to print ZATCA receipt, fuel attendant will bring his special card to RFID reader deployed near petrol pump.

- E-invoicing module will generate and send request to local printer for printing the receipt according to transaction provided by fuel pumps. There is no manual operation, the amount of fuel provided by pump corresponds exactly to amount shown in the receipt.

- Transaction will be saved and transferred to ZATCA server according to current regulation (stage #4).

- If there no need to print receipt on driver’s demand, stages #2 and #3 will be skipped. E-Invoicing module will proceed with stage #4.

Automation solution in conjunction with our forecourt controller PTS-2 forecourt controller provides full control under each dispensed liter. At the state level that is the right option to eliminate all frauds, cheating and collect all taxes. All existing brands of fuel dispensers in the Saudi Arabia are well supported and can be linked to the system. Wireless solutions will simplify and speed up installations.

This solution gains many benefits for all involved participators – drivers, fuel retailers and independent owners and governmental regulation authorities. Technotrade in couple with local technical partners provides technical support, deployment and after sales assistance for all our clients in the KSA.