Solution of organization of fiscal account of petroleum products sales on petrol stations.

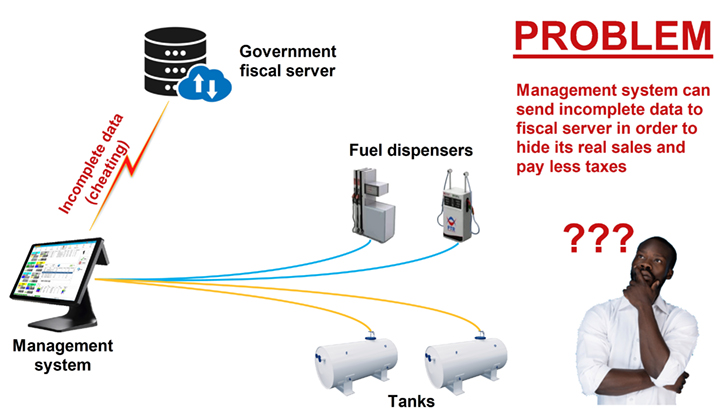

Nowadays, in many countries worldwide there are requirements to transfer information about gasoline sales from gas stations to the central server of governmental fiscal tax service. Size of the tax that gas stations should pay depends on the volume of fuel sold. There are seleveral approaches in a way to send data to a fiscal tax server and some of them have obvious weak places allowing cheating in order to pay less taxes.

We want to describe the problems with the traditional way and to show how it is possible to solve these problems with another approach bringing exact information to fiscal authorities and providing additional services to customers.

Traditionally the POS or management system is to take care of sending all the sales to the central fiscal server. At this the amount of the tax to pay depends on the amount of petroleum sold (the more sold - the bigger is the tax). Due to this the gas station owners often try to cheat and send smaller amounts to the tax server in order to pay less taxes to state treasury. So, information on part of the real sales performed on the petrol stations is not sent to the fiscal server, but stays hidden. As to the result, the state budget receives less taxes than needed.

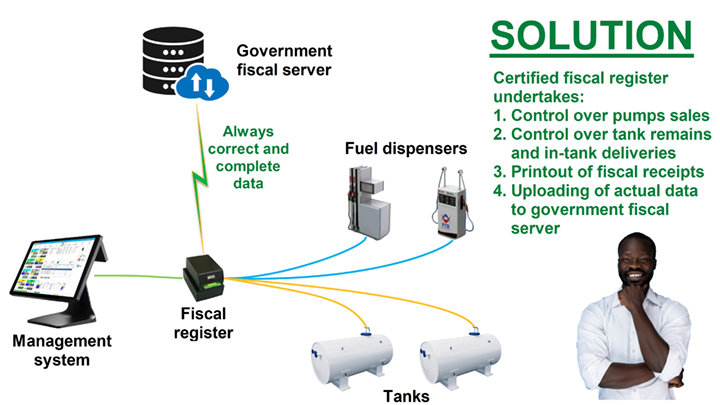

We in Technotrade company propose another approach for registration of the petroleum products sales and taxes based on implementation of special fiscal registers. We were the first one to adopt and implement this approach on petrol stations of Ukraine, where now fiscal account for petroleum products is provided at warehouses and petrol stations successfully during many years. This experience can be applied also in other countries. The basis of the current accounting system in Ukraine is the centralized control by the State Tax Service over each petrol station's balance between:

- received volume of petroleum products from fuel delivery trucks

- sold volume of petroleum through dispensers

- remains of petroleum volume in tanks

Certified fiscal registers are installed on each petrol station in between the local management system (POS or payment terminal) and the dispensers and tank's measurement systems. The fiscal registers are equipped inside with the forecourt controller and a receipts printer and guarantee that all the sales done through them are registered in internal non-erasable fiscal memory and uploaded to a tax server. These fiscal registers provide the following functions:

- automatic registration of petroleum products reception into the tanks of petrol stations using automatic tank gauging systems and tank calibration charts

- control over fuel dispensers and registration of the completed sales in the fiscal memory. The controller over dispensers is built-in inside the fiscal register and guarantees that all the performed sales are saved inside the fiscal memory, which is protected from distortion by external influences, there is no way to make sales without registration in the fiscal memory

- printout of fiscal receipts for customers

- provision of reports from the fiscal memory on all conducted transactions for the sales of petroleum products at the gas stations for any period

- transfer of fiscal data to the central server of the State Tax Service, so all performed sales are accounted and also the balance of the petroleum products volume received, sold and remained at petrol station is controlled

In Ukraine fiscal registers, their fiscal memory and software and the operation procedure are controlled and verified by the state body - the Center of Metrology and Standardization. This authority issues a permissions and maintains a list of fiscal registers approved for operation.

Information received to the server of the State Tax Service allows to analyze sales at each filling station: having information about the sales of any filling station and its configuration (number of tanks, fuel dispensers, level gauges, etc.).since the permit for the operation of filling stations is issued by the state only after providing such data. Inspectors of the tax service when conducting spot checks of gas stations have the opportunity to check the coincidence of the actual state of the gas station (and its equipment) with registered (declared upon receipt of a permit for the operation of gas stations), as well as to check the coincidence of information on sales recorded in the fiscal memory of the fiscal register and received from the server of the Tax Service. Such checks exclude the possibility for gas station owners to distort information about transactions to the tax service.

The accounting system used allows the State not only to control the volume of petroleum sales at each filling station, but also to see the overall balance of petroleum receptions on the market and the total sold volume at all filling stations. This allows the State to control the shadow turnover of petroleum products.

After commissioning of such fiscal registers into operation in Ukraine the amount of taxes collected from filling stations increased by 30%.

Technotrade LLC manufactures fiscal registers for Ukraine and is looking for regional partners worldwide for implementation of fiscal legislation into the regional markets and manufacture of fiscal registers.

In addition, Technotrade LLC offers:

- provision of consulting and assistance in implementation of technology of petroleum products fiscal accounting

- development/adaptation of national technical requirements for fiscal registers for filling stations

- determination of the appropriate level of automation of gas stations and petroleum depots

- drawing up methods and organizing the procedure for testing and certification of fiscal registers for gas stations

- development of cloud fiscal software

Implementation of the proposed fiscal registers can be organized in stages in order not to disrupt the work of gas stations.

Products in structure of this solution:

|

Fiscal printer for petrol stations

Fiscal printer for petrol stations is certified in Ukraine and includes 3 main parts inside of it: Fiscal module for petrol station - main part of the system, which is responsible for registration of fiscal data and printing of fiscal receipts using the printer, contr